34+ qualifying for a reverse mortgage

Department of Housing and Urban Development HUD requires all prospective reverse mortgage borrowers to complete a HUD-approved counseling session and borrowers must pay an origination fee and an up-front mor See more. Lesser of the value of the property home.

Fha Approved Condos Why Approval Is Vital For Buyers And Sellers

Web The minimum down payment for conventional loans is typically 3.

. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. To qualify for a reverse mortgage you must. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly.

Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator. Web To qualify for federally backed reverse mortgages known as Home Equity Conversion Mortgages or HECMs accounting for about 90 of the market you need to. Web Aside from age other reverse mortgage requirements include.

You must also meet financial eligibility. See if you qualify. For Homeowners Age 61.

Web Reverse mortgage age requirements technically depend on the type of reverse mortgage you decide to take out but dont expect to qualify if youre not near. You must either own. Use the home as your primary residence.

Web How To Prequalify For A Reverse Mortgage. Web Borrowers did not have to document their income and paying off credit card debt was a normal part of getting a reverse mortgage. For Homeowners Age 61.

Web Borrower Requirements. Ad While there are numerous benefits to the product there are some drawbacks. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You.

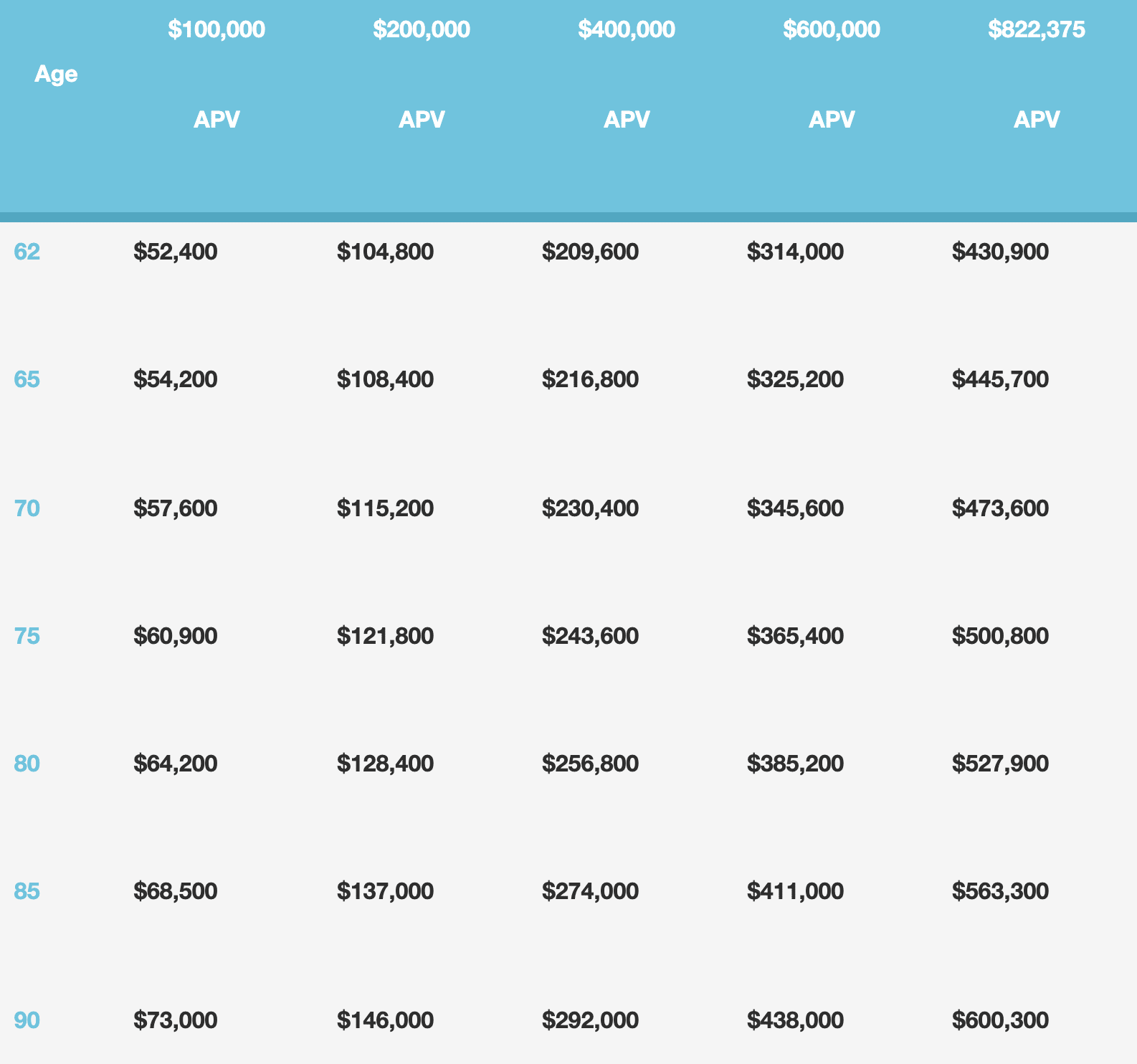

Web The maximum amount that can be received from a reverse mortgage loan depends on the following factors. Reverse mortgages have two primary qualification criteriayou must be at least 62. Web To qualify for a reverse mortgage homeowners must be able to pay their own property taxes homeowners insurance and home maintenance.

The reverse mortgage loan process has changed as of April 27 2015 to become more like conventional loans. Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Ad Dedicated to helping retirees maintain their financial well-being.

Web A reverse mortgage is a type of loan that allows homeowners ages 62 and older typically whove paid off their mortgage to borrow part of their homes equity as tax-free income. Be 62 years of age or older. Age of the youngest borrower.

Get A Free Information Kit. Web For example if you receive 2000 per month of non-taxable income a conventional lender can add an amount equal to 25 to the non-taxable income which. Web In general to be eligible for a reverse mortgage the youngest borrower on title must be 62 years old or older and have sufficient home equity.

Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Web A reverse mortgage can be an expensive way to borrow. All borrowers on the homes title must be at least 62 years old.

Your home must be your principal residence meaning you live there the majority of the year. Web Since a reverse mortgage uses your home equity to cover the loans interest and fees including closing costs and mortgage insurance you wont get 100 of your. For the last thirty years reverse mortgages.

Members of Generation X born between. Ad Compare the Best Reverse Mortgage Lenders. Your age and the age of other individuals registered on the title of your home where you live your homes.

HOA fees if applicable will. The older you are the more funds you can receive from a Home Equity Conversion. Ad Free Reverse Mortgage Information.

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. So if you plan to purchase a 300000 house youll need to offer 9000 cash as a down. Compare Pros Cons of Reverse Mortgages.

Web Borrowers must be at least age 62 to qualify for a home equity conversion mortgage HECM which is a reverse mortgage thats backed by the federal government. Web The enhancement lowers the minimum qualifying age for homeowners applying for this reverse mortgage product from 60 to 55 years of age in certain states. Web When you apply for a reverse mortgage your lender will consider.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. The fees and other costs to borrow money this way can be higher than other alternatives like a home equity loan or. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

How Does Reverse Mortgage Age Limit Affect Your Eligibility

National Mortgage Professional Magazine April 2017 By Ambizmedia Issuu

What Is A Reverse Mortgage Reverse Mortgage Requirements

Reverse Mortgage Loan Qualifications Requirements Seniorliving Com

Discover The Latest Age Requirements For Reverse Mortgages In 2023

How Does Reverse Mortgage Age Limit Affect Your Eligibility

Reverse Mortgages Florida Access Reverse Mortgage

Reverse Mortgage Age Requirement Minimum Goodlife

All Reverse Mortgage Inc Reviews Reversemotgagereviews Org

Discover The Latest Age Requirements For Reverse Mortgages In 2023

3 Important Qualifications For A Reverse Mortgage In 2023

Reverse Mortgage Qualification How We Determine Eligibility After April 27 2015 Premier Reverse Mortgage

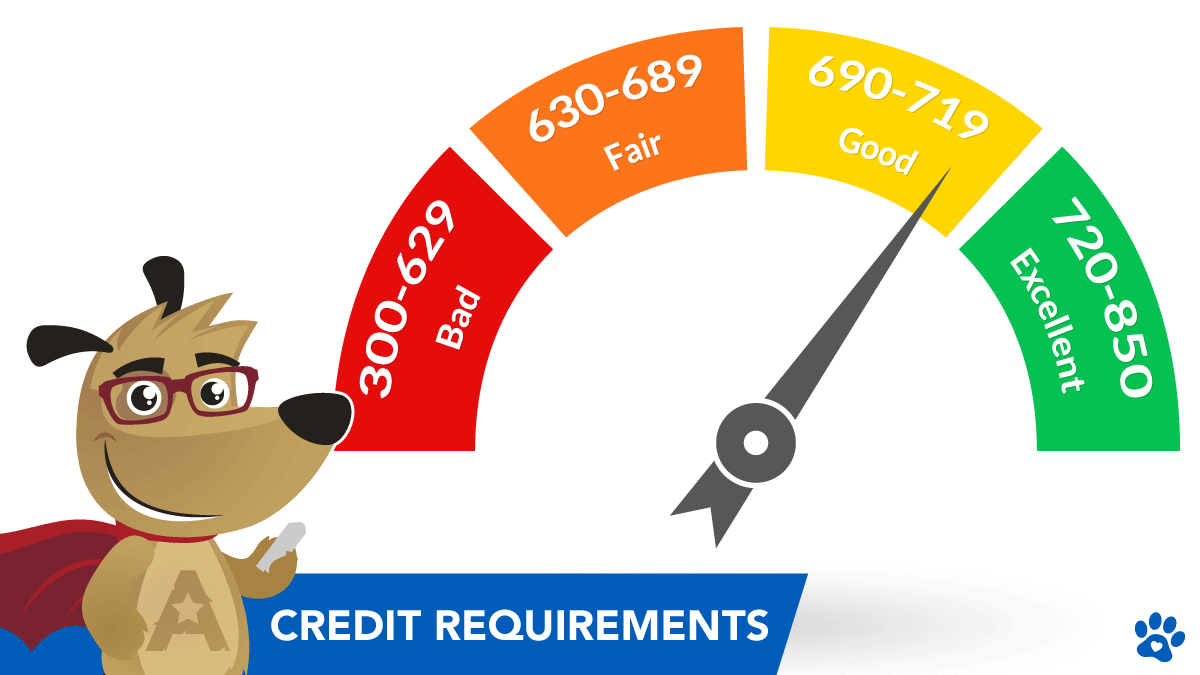

Credit Requirements For A Reverse Mortgage In 2023

Jessica Rix Mortgage Broker In Mildura Mortgage Choice

Nahb Report Optimistic About Reverse Mortgages

Reverse Mortgage Age Requirement Minimum Goodlife

Here Are The Income Requirements For A Reverse Mortgage