2021 tax brackets calculator

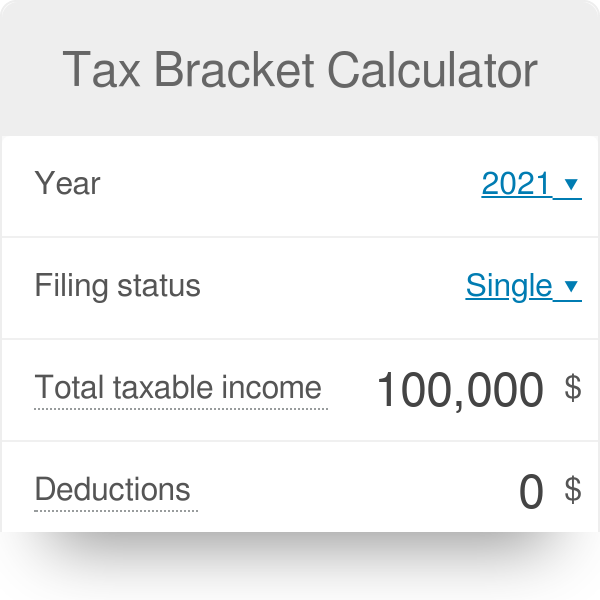

Use our Tax Bracket Calculator to answer what tax bracket am I in for your 2021-2022 federal income taxes. If your Income is Rs.

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

2021-2022 Tax Brackets and Federal Income Tax Rates.

. The federal tax rates in Canada follow the same pattern with rates increasing as your taxable income goes up. See this Tax Calculator for more. If taxable income is over.

What is changing is the level of income in the first two tax brackets. These are the federal income tax brackets for 2021 and 2022. Oklahoma state income tax rate table for the 2022 - 2023 filing season has six income tax brackets with OK tax rates of 025 075 175 275 375 and 475 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

Income Tax Calculator British Columbia 2021 Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. Income Tax calculator is a Free Tax Calculator that helps you in calculating Income Tax based on your Income. Your taxable income places you in the following tax brackets.

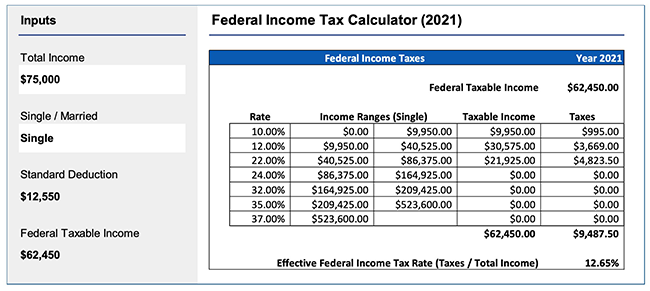

2021 FICA tax calculator is the easiest and fastest to know the social security tax and Medicare tax liability and also compute the additional medicare tax. Imposes tax on income using by graduated tax rates which increase as your income increases. 10 12 22 24 32 35 and 37.

Your bracket depends on your taxable income and filing status. Federal tax bracket Federal tax rates Newfoundland and Labrador tax bracket. These are the rates for taxes due.

Estimate Your 2021 Child Tax Credit Advance Payments. Malaysia Income Tax Brackets and Other Information. Ontario income tax rates will be staying the same in 2021.

10 of the amount over 0. Internal Revenue Code Simplified A Tax Guide That Saves You Money. 15 on the first 50197 of taxable income and.

Estimate your tax refund and where you stand Get started. Based on your annual taxable income and filing status your tax bracket determines your federal tax rate. Easily calculate your tax rate to make smart financial decisions.

Oklahoma Income Tax Rate 2022 - 2023. Tax Bracket Federal. In FY 2022-23 there are 2 tax regimes Old and New.

Personal income tax rates begin at 10 for the tax year 2021the return due in 2022then gradually increase to 12 22 24 32 and 35 before reaching a top rate of 37. Mortgage interest and contributions to charity count as deductions. Find out your tax refund or taxes owed plus federal and provincial tax rates.

There are seven federal tax brackets for the 2021 tax year. 2019 Tax Bracket for Estate. 2021 Tax Brackets and Tax Rates for filing in 2022 Single.

The current tax rates 2017 consist of 10 15 25 28 33 35 and 396. For resident taxpayers the personal income tax system in Malaysia is a progressive tax system. Ontario Income Tax Brackets.

Income Brackets Old Tax Regime Slabs Income Tax. Your taxable income puts you in the following brackets. The capital gain tax calculator is a quick way to compute the capital gains tax for the tax years 2022 filing in 2023and 2021As you know everything you own as personal or investments- like your home land or household furnishings shares stocks or bonds- will fall under the term capital asset.

Income Tax Calculation 2021-22 Video. The IRS is no longer issuing these advance payments. For 2022 you pay.

This is called the indexing factor. The Oklahoma tax rates decreased 025 from last year while. See your tax bracket marginal and average tax rates payroll tax deductions tax refunds and taxes owed.

As of 2016 there are a total of seven tax brackets. Tax rates range from 0 to 30. 26 on the next 55233 of taxable income on the portion of taxable income over 100392 up to 155625 and.

Use our Salary Tax Calculator to get a full breakdown of your federal and state tax burden given your annual income and. Tax Hikes Tax Cuts. Use our simple 2021 income tax calculator for an idea of what your return will look like this year.

Ontario increases their provincial income thresholds and the basic personal amount through changes in the consumer price index CPI. Tax Rate Single filers Married filing jointly or qualifying widower. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates.

Province of residence Alberta British Columbia Manitoba New Brunswick Newfoundland and Labrador Northwest Territories Nova Scotia Nunavut Ontario Prince Edward Island Quebec. Ontario Provincial and Federal tax brackets. Rates are up to date as of June 22 2021.

Estimate your provincial taxes with our free Ontario income tax calculator. Dare to Compare Now. 2022 Federal Tax Brackets and Rates.

Australian income tax rates 20212022. Here are the Australian income tax rates and brackets for the 202122 financial year for Australian residents according to the Australian Taxation Office ATO. The new 2018 tax brackets are 10 12 22 24 32 35 and 37.

TurboTax free Canada income tax calculator for 2021 quickly estimates your federal and provincial taxes. 1993 saw a tax hike on the wealthy via two new brackets at the top and then 2001 through 2003 saw a series of tax cuts that lowered the tax brackets as follows. These tax rates are the same for 2022 but they apply to different income levels than in 2021.

Your taxable income places you in the following tax. Dont get TurboCharged or TurboTaxed. This financial year started on 1 July 2021 and ends on 30 June 2022.

Tax Changes for 2021 - 2022 - 2020 rates have. Start Child Tax Credit Calculator. Youll get a rough estimate of how much youll get back or what youll owe.

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Reduction

Free Income Tax Calculator For Ay 2019 20 2020 21 Eztax In Help Filing Taxes Accounting Accounting Software

Find The Federal And State Income Tax Forms You Need For 2019 Official Irs Tax Forms With Instructions Are Printable And Can Be Income Tax Irs Taxes Tax Forms

Download Excel Based Income Tax Calculator For Fy 2020 21 Ay 2021 22 Financial Control Income Tax Income Tax

Excel Formula Income Tax Bracket Calculation Exceljet

Sales Tax Calculator

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Taxcaster Free Tax Calculator Estimate Your Tax Refund Turbotax Tax Refund Turbotax Tax

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Tax Calculator Refund Return Estimator 2021 2022 Turbotax Official

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return

Click Here To View The Tax Calculations Income Tax Income Online Taxes

Tax Bracket Calculator

Tax Calculator Estimate Your Income Tax For 2022 Free

Inkwiry Federal Income Tax Brackets